The Crumbling Iran Deal Could Make Russia Rich

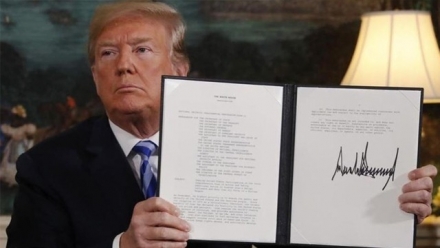

'U.S. President Donald Trump’s withdrawal from the Iran deal and his decision to reinstate sanctions on Tehran has been met with strong international criticism, including from Russia. But for Moscow, the U.S. president's decision also presents it with a rare economic opportunity.' says ANUCES recent PhD graduate Dr Elizabeth Buchanan, in this article featured in both The Moscow Times and Russian Insight.

Below is an excerpt of the article, but you can read the full article here.

Moscow’s support for Joint Comprehensive Plan of Action (JCPA) not only opens the door for communication and cooperation with the West, it gives the Kremlin international credibility in its elusive quest for international stature.

The U.S. exit from the Iran deal affords Putin a lot more than being “on the right side of history.” There is now a striking opportunity for Russia to bolster its strategic interests within the Iranian energy sphere.

Iran is second behind Russia in global natural gas reserves and it holds the fourth largest reserves of global oil. In addition to its natural resource wealth, Iran is situated within crucial corridors for global energy trade.

Given the superpower ambitions of Russia’s energy sector, it is not surprising that Iran’s energy wealth and geographical position are of paramount interest to the Kremlin.

Developing a strategic energy relationship with Tehran, shaped by majority stakes in projects across Iran’s untapped natural gas fields and the planning of pipeline corridors from Iran to Syria and onward to Europe are central drivers for Russia.

The U.S. Treasury has already hinted at when it will reinstate sanctions on Iran’s energy industry. The first round is expected to hit Aug. 6. By Nov. 4, energy sector sanctions including the use of Iranian ports, engagement in commercial shipping, buying petrochemical and petroleum products, will be reinstated. (Those sanctions will come into effect after a 180-day grace period.)

U.S. National Security Advisor John Bolton has also now confirmed that European energy firms engaged with Iran will be subjected to U.S. sanctions after this 180-day wind-down period.

The following day, Nov. 5, U.S. entities will be blocked from engaging in financial transactions with Tehran.

View further articles by Dr Buchanan in The Moscow Times.